Non-Convertible Debenture

To ensure the smooth operation of their businesses, companies require

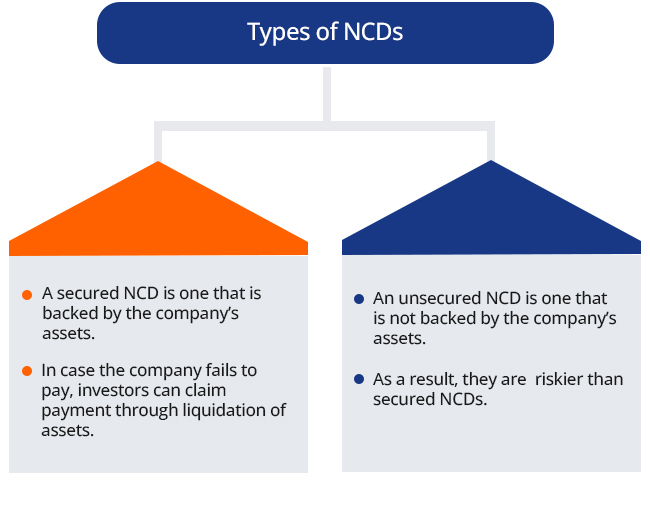

capital. One way We raise long-term capital is by issuing Non-Convertible

Debentures (NCDs), which belong to the category of debt-based financial

instruments. NCDs are fixed-income instruments offered by reputable

companies to gather capital from the general public. Unlike convertible

instruments, NCDs cannot be converted into equity shares. Due to their

non-convertibility, NCDs generally offer higher interest rates.

It is important to note that investing in NCDs does not grant any present

or future ownership in the company, unlike holding shares.

NCDs

solely provide an opportunity to earn regular interest payments until the

agreed-upon tenure is completed. At the end of the specified period, the

company redeems the debenture, returning the invested capital. The

repayment of NCDs is backed by assets that have not been pledged for

securing other loans.

Benefits of NCDs

Taxation: Taxation Tax implications for NCDs depend on the investor's tax bracket. If NCDs are sold within a year, Short-Term Capital Gains (STCG) tax will be applicable based on the income tax slab rate. If the NCDs are sold after a year or before the maturity date, Long-Term Capital Gains (LTCG) tax will be applicable at a rate of 20% with indexation. The interest income from NCDs is taxed similarly to fixed income securities under the category of 'income from other sources.Credit rating: Credit rating agencies like CRISIL, CARE, etc., evaluate companies and assign them credit ratings to assess their potential. A higher credit rating indicates that the company has the ability to meet its credit obligations. Conversely, a lower credit rating suggests higher credit risks associated with the company. If an issuing company fails to make payments, rating agencies assign them a lower ranking.

Interest: NCDs may offer a relatively high-interest rate ranging from 7% to 9% if held until maturity. Interest payouts can be scheduled monthly, quarterly, semi-annually, or annually. Additionally, NCDs may also provide a cumulative payout option. Unsecured NCDs might offer a higher interest rate.