Alternative Investment Funds (AIFs)

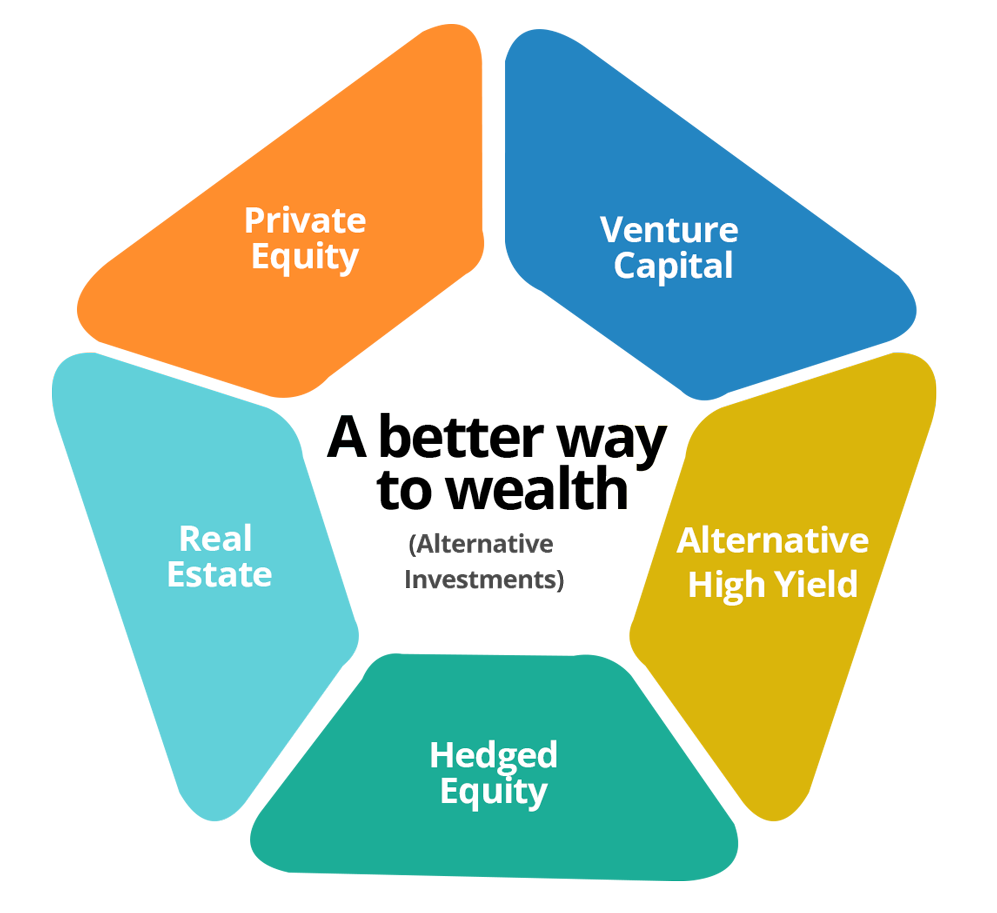

Alternative Investment Funds (AIFs) are a type of investment vehicle that allows individuals and institutions to invest their money in non-traditional or alternative assets. These funds are designed to provide investors with access to investment opportunities beyond the typical options like stocks, bonds, or mutual funds. Think of AIFs as a basket that contains a variety of unique investments. These investments can include private equity, venture capital, real estate, hedge funds, distressed assets, infrastructure projects, and other alternative assets. AIFs are managed by professional fund managers who specialize in these alternative investments.

The main purpose of AIFs is to provide investors with diversification and potential higher returns. By investing in a range of alternative assets, investors can spread their risk and potentially earn profits that may not be possible with traditional investments.

AIFs are typically available to high-net-worth individuals, institutional investors, and qualified investors who meet certain criteria. These funds often have specific investment strategies and objectives, such as focusing on specific industries, geographical regions, or stages of a company's growth.

One key feature of AIFs is that they are subject to less regulation compared to traditional investment funds like mutual funds.

This gives fund managers more flexibility in their investment decisions. However, it also means that investing in AIFs carries a higher level of risk and requires a deeper understanding of the investment strategies employed.

Investing in AIFs can be suitable for investors who are willing to take on higher risks in pursuit of potentially higher returns. It is important to carefully evaluate the fund's investment strategy, track record of the fund manager, and consider one's own risk tolerance and investment goals before investing in AIFs. Overall, AIFs provide an opportunity to invest in a diverse range of alternative assets beyond the traditional investment options. They offer the potential for higher returns but also carry higher risks. Investors should carefully consider their own financial situation, investment objectives, and seek professional advice before investing in AIFs.