Mutual Funds

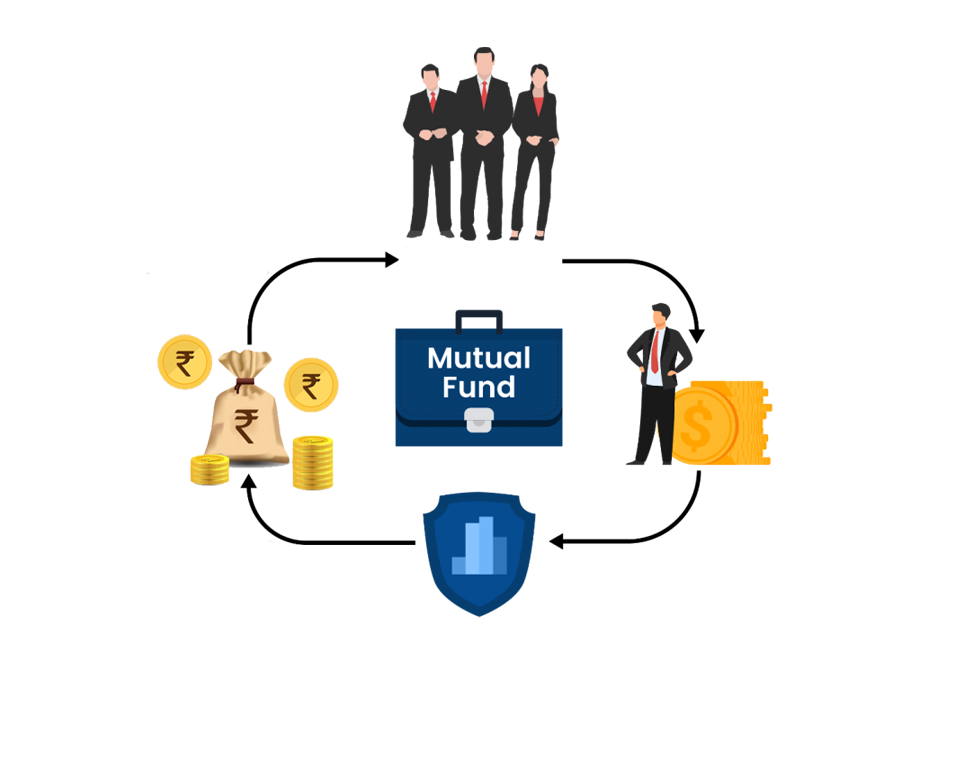

A mutual fund is a professionally managed investment vehicle that pools money from multiple investors who share a common investment objective.

The fund invests this money in a diversified portfolio of equities, bonds, money market instruments, and other securities. The income and gains generated from these investments are distributed proportionately among the investors after deducting expenses, and the value of a mutual fund's investment is calculated as its "Net Asset Value" or NAV. In simpler terms, a mutual fund is created by pooling money from numerous investors.

To illustrate the concept of a mutual fund unit, imagine a box of 10 Shirts priced at ₹4000. Two friends decide to buy the box, but We only have ₹2000 each, and the shirt can only sold in combo pack of 4. So, the two friend pool their money, contributing ₹2000 each, and purchase the Shirts together. Based on their contributions, We each receive 2 pieces of shirts, in terms of mutual funds. The cost per unit can be calculated by dividing the total amount by the total number of shirts: 4000/4 = 1000. Multiplying the number of units (2) by the cost per unit (1000) gives the initial investment of ₹2000. This means that each friend becomes a unit holder in the combo pack of shirt, collectively owned by all of them, making each person a part-owner of the box. Now, let's understand the concept of "Net Asset Value" or NAV. Just as an equity share has a traded price, a mutual fund unit has a Net Asset Value per Unit. NAV represents the market value of all the securities held by a mutual fund scheme on a specific day, adjusted for expenses and charges. NAV per Unit reflects the market value of all the units in a mutual fund scheme, net of expenses, liabilities, and accrued income, divided by the outstanding number of units in the scheme.

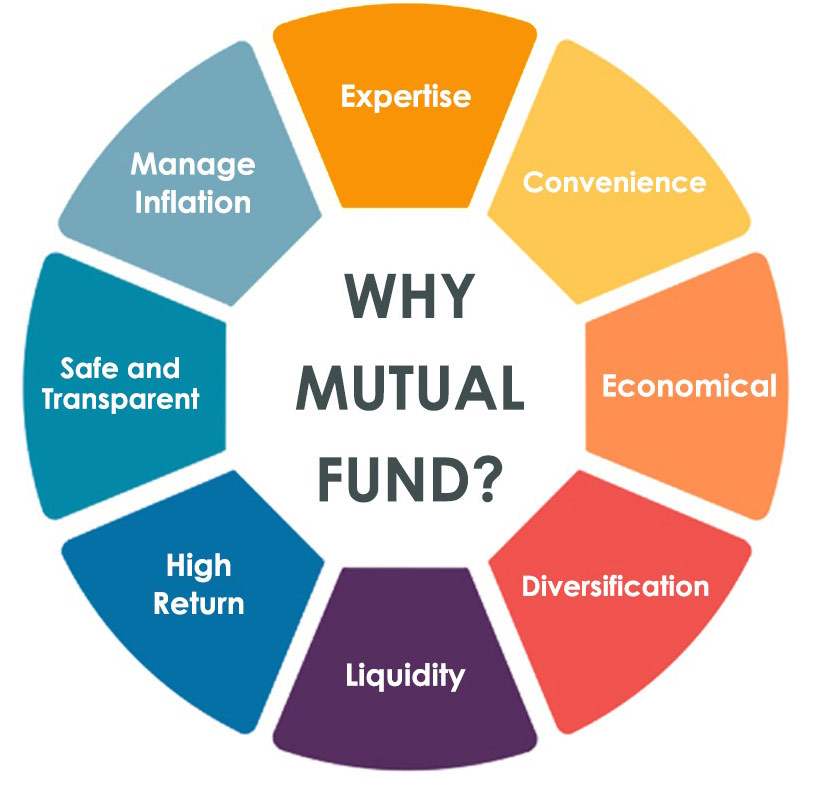

Mutual funds are ideal for investors who may lack substantial sums for investment or do not have the time or expertise to research the market but still want to grow their wealth.

Professional fund managers invest the money collected in mutual funds according to the fund's objective. In return, the fund house charges a small fee, regulated by the Securities and Exchange Board of India (SEBI), which is deducted from the investment. India has a high savings rate, and mutual funds provide an alternative investment avenue beyond traditional options like bank fixed deposits and gold. However, due to lack of awareness, mutual funds have been less favored. The Indian mutual fund industry offers a wide range of schemes catering to different investor needs and goals, such as post-retirement expenses, education or marriage expenses, or buying a house.