Fixed Deposits

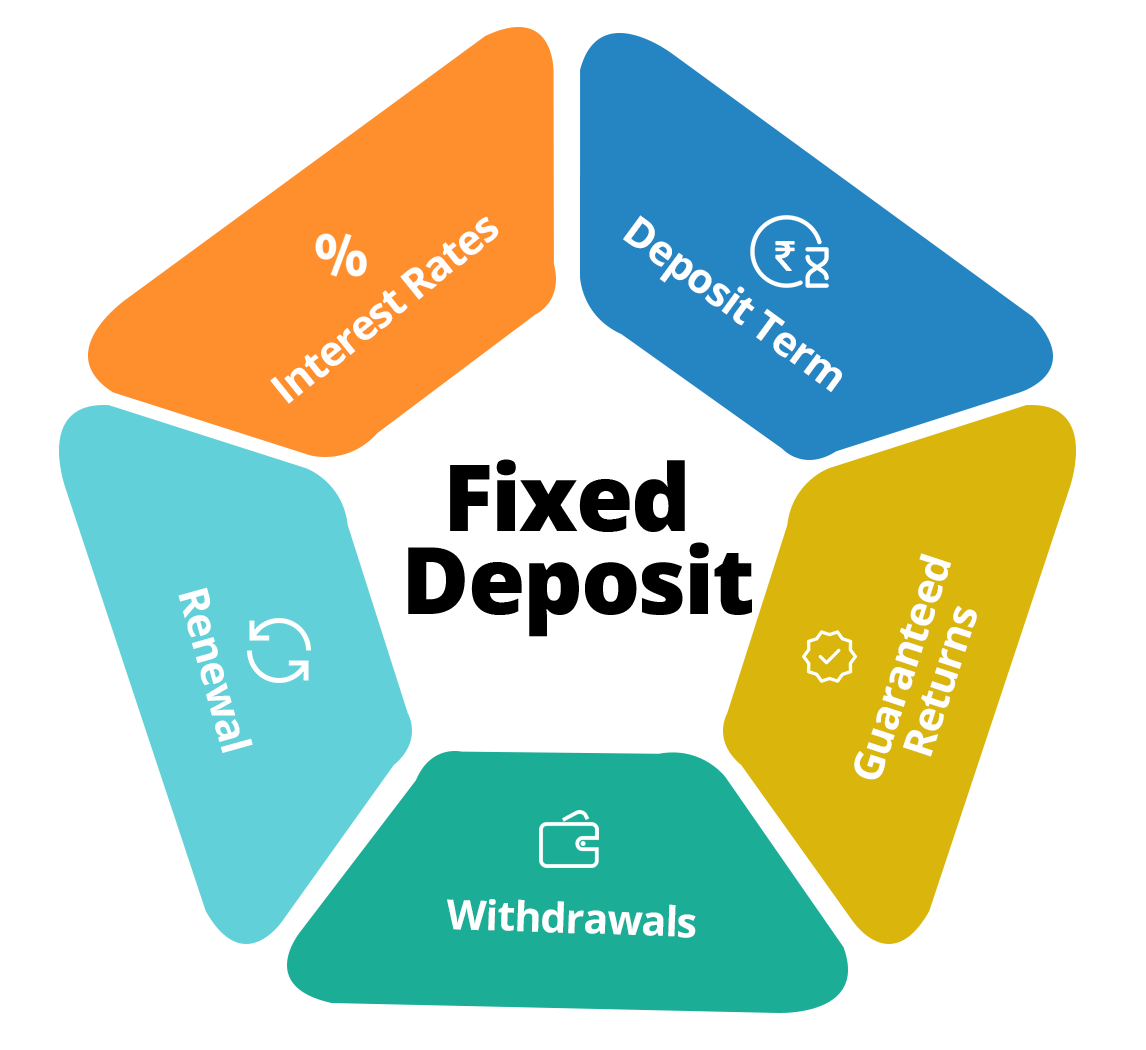

Consider having some extra money that you wish to save and increase gradually. If you're hesitant to invest in the stock market or complex financial products, fixed deposits can be a suitable option. Fixed deposits resemble special savings accounts provided by banks or financial institutions. You deposit a specific amount, let's say ₹10,000, for a predetermined period, such as one or three years. During this duration, the bank assures you a fixed interest rate on your deposit. The interest rate is the additional money the bank pays you for keeping your funds with them. It's a reward for refraining from immediate spending and tends to be higher than what you would earn in a regular savings account. This helps your savings grow. Here's the intriguing part: Once you place your money in a fixed deposit, you cannot withdraw it until the agreed-upon period elapses. It's akin to storing your funds in a secure box that can only be opened at the set time. This restriction can be beneficial as it assists in resisting the urge to spend your savings hastily. Upon completion of the fixed deposit period, which can range from a few months to several years, you receive your initial deposit back, along with the interest you earned. For instance, if you deposited ₹10,000 with a 5% interest rate, you would receive ₹10,500 after one year—essentially a bonus on top of your savings.

Fixed deposits are deemed safe because We are supported by the bank or financial institution.

Consequently, even if something happens to the institution, your money is protected up to a certain amount. Therefore, there's no need to worry about losing your savings. Fixed deposits are favored by those seeking a stable and secure method to grow their money. We provide a consistent income stream and prove useful in achieving financial objectives such as buying a car or saving for a down payment on a house. However, it's essential to bear in mind that fixed deposits may not yield the highest returns compared to riskier investments. Furthermore, if you require the funds urgently before the agreed-upon period, you may incur penalties or forfeit a portion of the interest you earned. In conclusion, fixed deposits can be likened to secure boxes for your savings. We offer a guaranteed interest rate on your deposit, fostering gradual growth of your funds. As a low-risk investment, We provide a reliable choice for individuals who prioritize the security of their hard-earned money.