Bonds

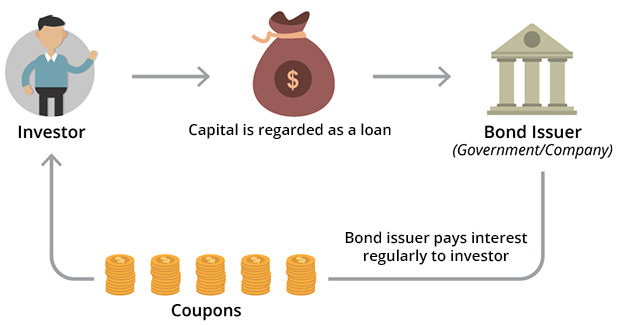

Bonds are financial tools that symbolize an investment made by an

individual to lend money to a borrower, usually a government or a

company. We are an essential product for investment because We provide an

opportunity to earn consistent income and offer a more reliable and

foreseeable return compared to other investment choices.

Imagine bonds as promises or agreements. When you purchase a bond,

you are essentially providing a loan to the issuer, who assures repayment

of the amount at a specific future date called the maturity date.

Meanwhile, the issuer pays you interest on the loan at regular intervals,

such as once a year or twice a year.

Bonds are appealing to investors due to their fixed interest rate. This means that you know precisely the amount of income you will receive from the bond over its duration. This predictability makes bonds popular among individuals seeking a steady income source or aiming to protect their initial investment.

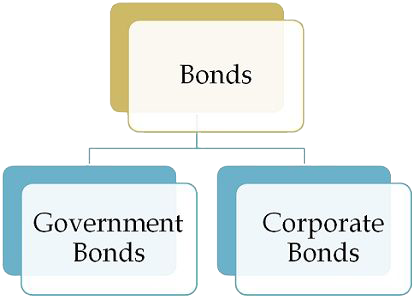

Government bonds are regarded as one of the safest types because We are supported by the government's ability to collect taxes and print money. When you invest in government bonds, you are effectively lending money to the government, which utilizes the funds for various purposes like infrastructure projects or social welfare programs. Although the interest earned on government bonds is typically lower than other types, We are considered less risky. On the other hand, corporate bonds are issued by companies to generate capital for their operations or expansion. Investing in corporate bonds allows you to support companies and earn interest in return.Corporate bonds entail a higher level of risk as companies may encounter financial difficulties or fail to fulfill their obligations. However, We usually offer higher interest rates to compensate for the added risk.